Many aspiring market participants wonder about fee recovery when joining evaluation programs. These assessments help people demonstrate their skills to access significant capital. The question of getting money back becomes crucial for smart financial planning.

Understanding reimbursement policies helps individuals make informed choices. Different companies offer various terms for successful candidates. Some provide immediate returns, while others wait for the first payout.

This guide explores how evaluation programs handle fee recovery. It examines the conditions under which participants might receive their investment back. Knowledge of these policies prevents disappointment and guides better selection.

The growing popularity of these programs has led to more favorable terms. Companies now compete to attract talented individuals with better offers. This benefits those seeking to build sustainable careers in financial markets.

Understanding the Prop Firm Refund Challenge Process

The assessment process used by capital providers serves as a comprehensive screening mechanism for identifying skilled market participants. These structured evaluations measure an individual’s ability to manage financial resources effectively. They create a fair playing field where talent can demonstrate real capability.

Overview of Prop Trading Evaluations

Evaluation programs require participants to pay an upfront fee that correlates with potential capital access. This investment demonstrates serious commitment from aspiring money managers. The fee structure varies significantly based on account size and firm policies.

Traders must achieve specific profit targets within designated timeframes. They simultaneously follow comprehensive rule sets that test both technical skills and emotional discipline. These parameters ensure only consistent performers advance to funded status.

Key Conditions and Performance Requirements

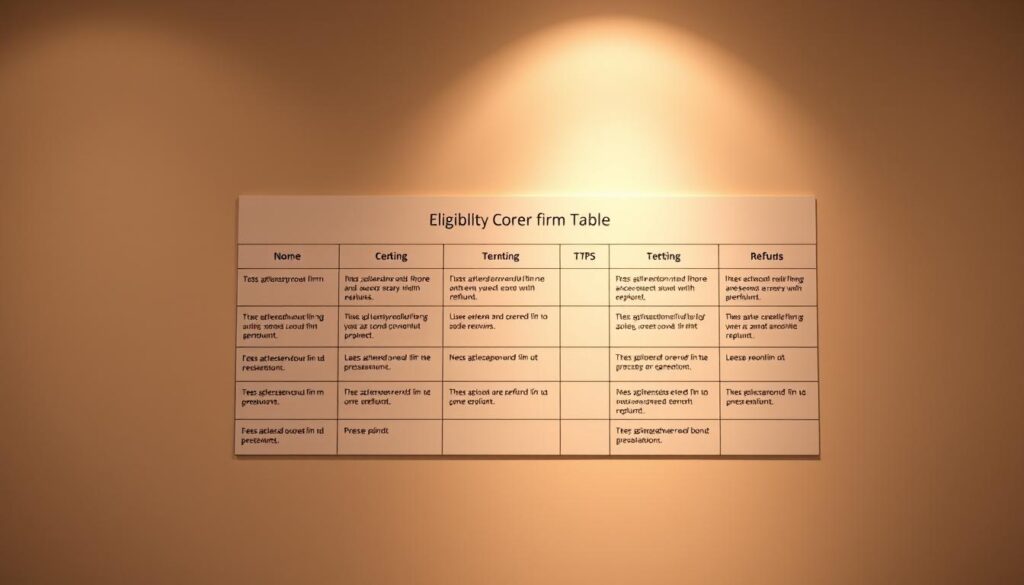

Successful candidates receive reimbursement of their initial evaluation fee after demonstrating profitable trading with live capital. This refund represents a significant financial incentive for high performers. It effectively makes the path to funded trading cost-free for those who succeed.

Key conditions include passing all evaluation phases and reaching funded trader status. Participants must also execute minimum trade requirements and generate consistent profits. Some companies issue refunds immediately, while others combine them with first profit withdrawals.

Examining How Prop Firm Challenges Work

Structured trading evaluations operate through clearly defined phases and strict parameters. These systems measure a participant’s ability to generate consistent returns while managing exposure. The process creates a fair assessment environment for all candidates.

Evaluation Steps and Rules

Most programs follow either one-phase or two-phase formats. In two-phase assessments, participants must first achieve an 8-10% profit target. Successful completion leads to Phase Two with a 5% target requirement.

Time constraints typically range from 30 to 60 days per phase. Some progressive companies have eliminated time limits entirely. This reduces pressure and encourages quality decision-making.

Additional evaluation rules often include minimum trading day requirements and position sizing limits. Restrictions on high-impact news trading protect against volatile market conditions. Understanding all conditions before starting proves essential for success.

Risk Management and Capital Allocation

Daily drawdown limits typically cap losses at 4-5% of account balance. Maximum overall drawdown restrictions range from 8-10% from starting equity. These parameters serve as critical disqualification triggers.

Capital allocation follows a progressive model during evaluation. Participants demonstrate skills on smaller simulated accounts first. Successful traders gain access to substantially larger funded accounts afterward.

Risk management principles form the foundation of every assessment program. Preservation of capital takes priority over aggressive profit-seeking. This approach identifies traders who can sustain long-term performance.

The Role of Refunds in Prop Trading

Fee recovery represents a critical component in the relationship between capital providers and skilled market participants. These reimbursement systems create mutual benefits for both parties involved in the evaluation process.

What Constitutes a Refund in Prop Trading?

Reimbursement typically involves returning the initial evaluation fee after successful completion of all program phases. Different companies establish varying conditions for this financial return.

Some organizations provide immediate reimbursement upon passing the evaluation. Others require demonstration of profitability with live capital first. The most common approach combines the fee return with the first profit withdrawal.

Incentives Behind Challenge Refunds

These financial returns serve as powerful motivational tools for participants. Knowing they can recover their initial investment encourages greater commitment to the process.

The reimbursement system also builds essential trust between companies and participants. It demonstrates the organization’s genuine interest in identifying talented individuals. This alignment of interests promotes sustainable profit generation for both parties.

Understanding specific reimbursement terms helps participants select programs that match their financial goals. This knowledge enables better planning and risk management throughout the evaluation journey.

Mastering the prop firm refund challenge: Eligibility & Steps

Successful navigation of evaluation programs requires meeting specific refund qualification standards. These criteria ensure participants demonstrate genuine trading skill before receiving financial returns. Understanding these requirements helps individuals approach the process strategically.

Criteria for Earning a Refund

Traders must complete all evaluation phases by hitting profit targets while following all rules. This typically means achieving 8-10% in Phase One and 5% in Phase Two for two-stage assessments. Consistent performance throughout the entire period proves essential.

Advancement to funded status triggers reimbursement consideration. Most organizations require additional verification through initial live account trading. This confirms the participant’s success stems from skill rather than luck.

Step-by-Step Guide to Success

The journey begins with careful company selection matching one’s trading style. After paying the one-time access fee, disciplined evaluation trading follows. Risk management takes priority over aggressive profit-seeking during this phase.

Upon passing the assessment, traders receive live account credentials. They continue applying the same disciplined approach that earned them funding. The refund typically processes with the first profit withdrawal.

This system effectively makes the entire evaluation cost-free for successful individuals. Understanding the fee as an investment in professional qualification transforms the psychological approach. This perspective encourages sustainable trading practices that benefit both participants and capital providers.

Risk Management and Strategy for Passing Challenges

Developing a robust risk management framework separates successful candidates from those who fail evaluations. This approach forms the foundation of any effective trading strategy. Smart capital protection ensures long-term viability in markets.

Implementing Smart Stop-Loss Techniques

Professional traders understand that disciplined stop-loss placement protects their accounts. They typically risk only 1-2% of capital per trade. This conservative approach prevents catastrophic losses.

Effective position sizing maintains account health during losing streaks. The 1% rule ensures multiple losses won’t trigger violation thresholds. This method creates mathematical safety margins for sustained performance.

Traders should target risk-reward ratios of 1:2 or higher. This means aiming for twice the potential profit compared to risk. Such ratios provide statistical advantages even with moderate win rates.

Maintaining Consistency Under Pressure

Evaluation programs favor steady, incremental gains over volatile results. Consistent profitability demonstrates genuine skill rather than luck. This approach aligns with company expectations for funded participants.

Psychological discipline helps traders execute their strategy systematically. Emotional control prevents impulsive decisions during stressful periods. Taking breaks after losses maintains clear thinking.

Setting realistic daily targets breaks large goals into manageable steps. Trading only during optimal conditions matches strategy requirements. These practices build the consistency needed for success.

Common Pitfalls in Prop Firm Challenges

The path to becoming a funded trader contains predictable traps that eliminate most candidates. Understanding these common errors helps participants avoid repeating them.

Overtrading and Breaching Drawdown Limits

Many individuals execute too many positions trying to reach targets faster. This compulsive behavior increases errors and transaction costs.

Overtrading often stems from impatience or desperation after losses. Each extra trade compounds risk exposure. Traders may breach daily loss thresholds even with positive net performance.

Failing to use stop-loss orders represents another critical error. Unprotected positions can spiral during volatile markets. Single trades might wipe out significant account portions.

Emotional Trading and Its Consequences

Fear, greed, and stress undermine the disciplined approach needed for success. These emotions cause deviation from proven strategies.

Fear manifests as hesitation during valid opportunities. Greed encourages position oversizing and inadequate risk management. Stress impairs judgment after losing streaks.

Establishing comprehensive trading plans prevents these common mistakes. Maximum daily trade limits and mandatory stop-loss protocols create essential structure. Systematic emotional discipline maintains consistency regardless of intermediate results.

Low-Cost Prop Firm Challenges and Refund Opportunities

Budget-conscious traders now have unprecedented access to professional trading capital through affordable evaluation programs. These cost-effective options remove financial barriers that once prevented many from pursuing funded trading careers.

Exploring Affordable Challenge Options

Many organizations offer tiered pricing structures that accommodate various financial situations. Funding Traders provides a clear example with accounts starting at $50 for a $5,000 beginner level.

The pricing scales proportionally to $1,100 for a $200,000 superior account. This allows individuals to select evaluation sizes matching their budget and skill confidence.

These affordable programs maintain identical evaluation standards as higher-priced alternatives. Successful participants receive the same funding opportunities regardless of their initial investment level.

Leveraging Discount Offers and Promotions

Seasonal promotions and discount codes provide additional savings opportunities. Many companies offer percentage reductions ranging from 5% to 70% during special campaigns.

Traders should monitor company announcements through social media and newsletters. Funding Traders regularly provides exclusive offers like their “BLOG” code for 30% savings.

Always verify that discounted fees don’t correlate with unfavorable terms. The evaluation conditions and refund policies should remain identical to standard offerings.

These strategic approaches make professional trading accessible to wider audiences. They demonstrate the industry’s commitment to identifying talent regardless of financial starting points.

Choosing the Right Prop Firm for Your Trading Style

Selecting the appropriate capital provider model requires understanding how different evaluation structures align with individual trading approaches. This decision significantly impacts success probability and overall experience.

Three primary models dominate the landscape today. Each caters to specific trader profiles and methodologies.

Evaluating Firm-Specific Rules and Conditions

Thorough examination of operational boundaries proves essential before commitment. Key factors include daily loss limits, permitted instruments, and position sizing requirements.

Restrictions on news trading or weekend holdings particularly affect certain strategies. Minimum trading day obligations also influence planning.

These conditions collectively define the operational framework for market participation. Understanding them prevents unexpected violations.

Matching Trading Strategies with Firm Models

Challenge-based programs suit individuals comfortable with structured timelines and profit targets. They offer clear pathways through phased assessments.

Instant funding options benefit experienced participants confident in immediate profitability. These models prioritize time efficiency over cost savings.

Hybrid approaches provide greater flexibility for swing traders and part-time participants. They remove pressure points like strict deadlines while maintaining risk parameters.

Scalpers need minimal trade frequency restrictions. Position traders require generous time allowances. Proper alignment creates sustainable success conditions.

Fine-Tuning Trading Strategies for Refund Success

Strategic refinement separates consistent performers from occasional market participants in evaluation programs. This process involves developing comprehensive systems with clear entry and exit criteria. Proper strategy testing in demo environments builds confidence before live assessments.

Optimizing Market Analysis Techniques

Multi-timeframe analysis dramatically improves trade quality. Traders first examine daily charts to identify dominant trends. Then they drill down to hourly charts for precise entry timing.

This hierarchical approach ensures positions align with broader market momentum. It reduces premature stop-outs and increases profit target achievement. Popular methodologies include price action, breakout systems, and trend following.

Continuous Improvement and Strategy Adaptation

Maintaining detailed journals documents every trade’s technical rationale and emotional context. Regular analysis identifies behavioral patterns and strategic strengths. This data-driven approach enables meaningful adjustments.

Breaking large targets into smaller daily goals maintains steady progress without excessive risk. Strategy evolution based on performance insights ensures long-term success. Adaptation to changing market conditions proves essential for sustained results.

Final Insights on Navigating a Prop Firm Refund Challenge

The evolution of capital access programs has created unprecedented opportunities for skilled individuals worldwide. These structured evaluations test more than just profit generation—they assess comprehensive trading discipline and risk management capabilities.

Success demands balancing technical skills with emotional control throughout each evaluation day. Consistent execution proves more valuable than spectacular short-term gains. This approach aligns with what capital providers seek in funded traders.

Making informed decisions about program selection becomes as crucial as developing market analysis skills. The diversity of available models means virtually every trading style can find suitable options. Careful preparation and realistic target setting dramatically increase success probabilities.

Ultimately, these programs represent democratized pathways to professional trading careers. They transform initial investments into recoverable opportunities for those demonstrating genuine capability.